Owning a vacation home is often seen as the ultimate luxury, providing a private retreat while also offering potential financial benefits. If you’ve ever considered buying a vacation home, particularly in a prime location like Bali, this guide will walk you through the benefits, considerations, and financial implications of such an investment.

Why Owning a Vacation Home in Bali is the Best Summer Upgrade

As summer approaches, many people dream of escaping to a serene location to unwind and soak in the sun. Bali, with its stunning beaches, vibrant culture, and tropical climate, presents an ideal destination for those looking to invest in a vacation home. Here’s why owning a vacation home in Bali could be the best summer upgrade for you:

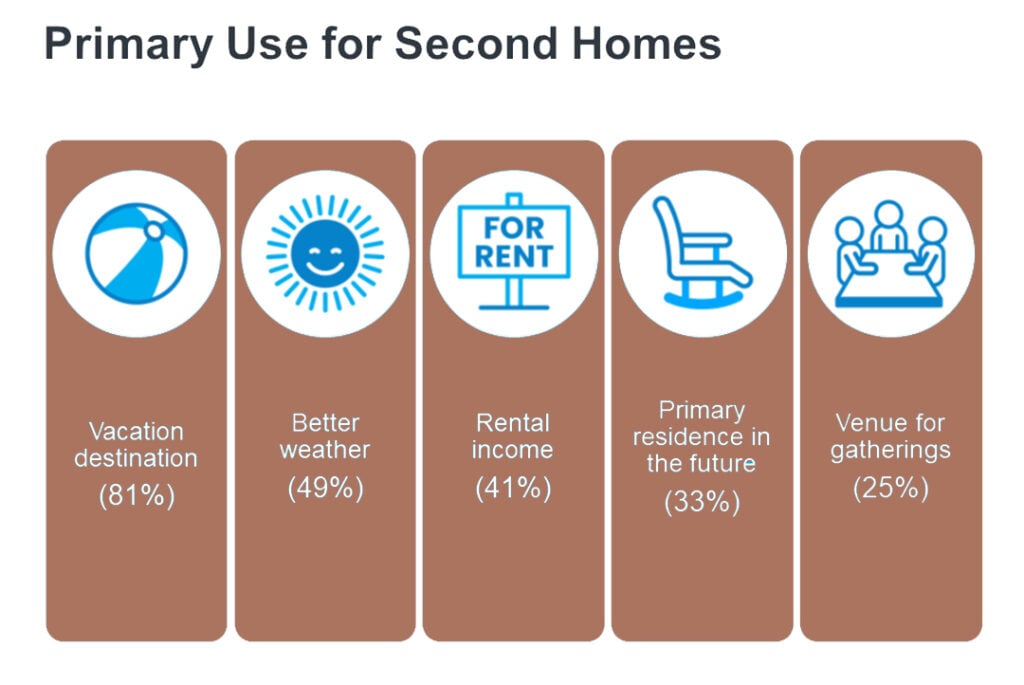

- Permanent Vacation Spot: A vacation home in Bali offers a guaranteed place to stay whenever you want to escape the daily grind. No more worrying about hotel bookings or subpar accommodations.

- Better Weather: Bali’s tropical climate is perfect for those looking to escape colder or rainier regions. Enjoy sunny days, warm temperatures, and a relaxed island vibe year-round.

- Rental Income Potential: When you’re not using your Bali vacation home, you can rent it out to other travelers. With Bali being a top tourist destination, this can generate a steady income stream, offsetting your mortgage or even turning a profit.

- Future Primary Residence: Many vacation homeowners plan to retire in their second homes. A Bali property can serve as your vacation spot now and your retirement haven in the future.

- Venue for Gatherings: Your Bali vacation home can be the perfect spot for family get-togethers, celebrations, and creating lasting memories with loved ones.

10 Reasons Why You Should Invest in a Vacation Home in Bali

Investing in a vacation home, especially in a location like Bali, comes with a plethora of benefits beyond just having a place to escape to. Here are ten compelling reasons to consider this investment:

- Always Have a Place to Stay: Avoid the hassle of booking hotels or rentals during peak seasons. Your vacation home in Bali will always be ready for you.

- Proximity to Favorite Activities: Bali offers world-class surfing, diving, and cultural experiences. Owning a home here means you’re always close to your favorite activities.

- Host Special Occasions: A Bali vacation home is an ideal location for hosting holidays, birthdays, and special events in a picturesque setting.

- No Need to Pack Everything: Keep essentials at your vacation home so you can travel light. Stock up on clothes, beach gear, and other necessities, ready for your arrival.

- Change of Scenery: Whether it’s a weekend getaway or a long retreat, a vacation home in Bali provides a refreshing change of scenery from your primary residence.

- Less Financial Burden: Frequent visits to your vacation home reduce the need to plan and budget for costly vacations.

- Connection to the Local Community: By owning a property in Bali, you become part of the local community, enjoying a deeper connection with the culture and people.

- Income Generation: Bali’s popularity as a tourist destination means high demand for vacation rentals. This can turn your vacation home into a lucrative investment.

- Residency Benefits: Owning property in Bali may offer residency opportunities, particularly for those interested in retiring or spending extended periods in Indonesia.

- Tax Advantages: Similar to your primary residence, you may be able to deduct mortgage interest and property taxes on your Bali vacation home.

Is a Vacation Home in Bali a Good Investment?

Owning a vacation property is more than just an emotional decision; it’s a significant financial commitment that should be evaluated carefully.

The costs of buying a vacation property

Let’s consider a scenario where a property is priced at $500,000. Whether you’re paying in cash, using a mortgage, a home equity line of credit, or a combination of these, additional costs need to be factored in.

If you choose to pay with cash, which you might otherwise invest for an estimated 4.5% return (a conservative figure), you face an opportunity cost for not investing that money. If you decide to borrow, the interest on the loan could also be around 4.5%. For simplicity, let’s assume an opportunity or financing cost of 4.5%.

On top of that, property taxes, utilities, insurance, condo fees, and maintenance can add another 2% to 4% in annual expenses. These costs might be even higher for an older property or one with extensive amenities, but for this example, we’ll use an average of 3% per year.

Adding these figures together, the total annual cost for a $500,000 property could reach 7.5%, equating to $37,500 per year for our hypothetical vacation home.

Expected Returns on Vacation Properties in Bali

When considering the financial return on owning a vacation property in Bali, it’s important to look at the market trends specific to this region. Bali’s real estate market has shown consistent growth over the past decade, driven by its popularity as a tourist destination and the increasing demand for both residential and commercial properties.

On average, property prices in Bali have appreciated by about 5% to 7% annually over the past 10 years, depending on the location and type of property. Prime areas such as Seminyak, Canggu, and Uluwatu have experienced even higher growth rates, reflecting their desirability among both local and international buyers.

If we assume the value of a $500,000 property in Bali grows at an average rate of 5% per year, this would translate to a $25,000 increase in value during the first year. Given the estimated annual costs of owning the property, including maintenance, taxes, and opportunity costs, which might total around 7.5% (or $37,500), the net cost in the first year would be reduced to 2.5% (or $12,500) when accounting for property appreciation.

This potential for growth, combined with the opportunity to generate rental income from the property, makes Bali a compelling market for vacation property investment.

Tax Implications of Renting Your Vacation Home in Bali

If you’re considering renting out your vacation property in Bali to generate income, this can help offset the costs and make the purchase more financially viable. However, it’s important to understand the tax implications involved.

Rental income in Indonesia is subject to taxation, and as a property owner, you are required to declare this income. Fortunately, renting out your vacation home also allows you to claim certain tax deductions. These deductions are typically proportional to the amount of time the property is rented out. For example, if you use your Bali property for six months of the year and rent it out for the remaining six months, you may be able to deduct half of your eligible expenses.

Eligible expenses for tax deductions in Bali may include:

- Mortgage interest (if applicable)

- Property taxes

- Maintenance and repairs

- Utilities (electricity, water, internet)

- Insurance

- Property management fees

- Other related costs, such as advertising for rentals

Additionally, if your rental income exceeds a certain threshold (for example, the equivalent of $30,000 USD over four consecutive quarters), you may be required to register for and collect Value-Added Tax (VAT) in Indonesia. This is particularly relevant for short-term rentals, which are common in Bali.

If your property is used as a holiday rental for more than half of the year, additional tax considerations may arise, such as VAT implications when selling the property or converting it back to personal use. Therefore, consulting with a local tax professional is essential to navigate the complex tax landscape and ensure that your holiday rental remains a profitable and compliant investment in Bali.

Conclusion: Should You Buy a Vacation Home in Bali?

Owning a vacation home in Bali is a dream for many, offering both a personal retreat and a smart investment opportunity. However, it’s important to weigh the pros and cons, consider the financial implications, and consult with professionals before making a decision.

Whether you’re looking to relax in your own tropical paradise, generate rental income, or plan for retirement, a vacation home in Bali can be an excellent choice. With careful planning and the right guidance, you can make a well-informed decision that aligns with your lifestyle and financial goals.